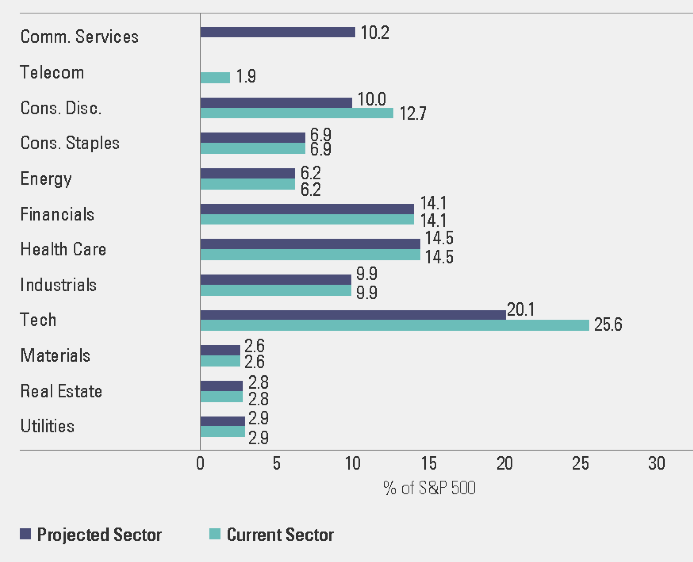

On September 21, the largest reorganization of GICS Industry Sector classification will take place. GICS – the Global Industry Classification Standard – is a joint venture between Standard & Poor’s and MSCI that defines sectors and industries and classifies individual stocks to them. The impetus for this change is the growth of companies around Internet communication (Facebook, Google etc) and the blurring of distinctions between content providers, such as media and advertising companies, and providers of communications networks, such as operators of cellular or cable networks. The old Telecommunications Sector, home to just three stocks (AT&T, Verizon and CenturyLink) and representing less than 2% of the index, will be renamed as simply the Communications Services Sector. Media and cable stocks from the Consumer Discretionary Sector, along with Internet content providers such as Google and Facebook from the Technology Sector, will be moved to the new classification. Using July 31 values, State Street (the largest provider of S&P 500 index funds and ETFs) estimates the following changes to S&P 500 sector weights.

Source: https://us.spdrs.com/docs-commentary/gics-sector-structure-changes.pdf

In this analysis, the Technology sector weight declines from 25.6% of the S&P 500 to 20.1% and the Consumer Discretionary drops from 12.7% to 10.0%. The new Communications Services sector constitutes 10.2% of the S&P 500.

We view this as a logical change to keep up with the impact and importance of communication networks and content to a modern economy. While there might be some short term volatility from repositioning sector-focused ETFs, there is no real long term investment impact from this classification change. Your third quarter reports will reflect the new definitions where applicable.