Articles

Tariff Volatility

Why is the market selling off today when everyone knew that tariffs would beannounced? The Tariff announcement far surpassed expectations The administration’s tariff announcement today surpassed expectations and resulted in broadstock market declines. The dollar also declined, and the benchmark 10-year Treasury BondYield fell by

DeepSeek Changes the Narrative

Humans thrive on stories. Psychological experiments document their effectiveness in communicating information and changing behavior. Neurologists measure the actual changes in brain chemistry that they trigger. It is no surprise then that stories drive equity markets. A compelling narrative about a technological revolution or, alternatively,

Election Commentary

This information is presented for educational purposes only and does not constitute an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with

Third Quarter 2024 Commentary

After the NVIDIA-driven first half of the year, equity markets broadened during the third quarter. Small cap stocks, emerging and developed non-US markets posted double-digit year-to-date gains. Large cap US growth stocks still retain the lead due to their strong performance during the first half of the year.

Don’t forget about small caps!

The Importance of Small Cap Stocks in a Diversified Portfolio Small cap stocks, as defined by the popular, but flawed, Russell 2000 Index comprise approximately 6% of the total US market today. The record outperformance of large cap names over the past decade led many

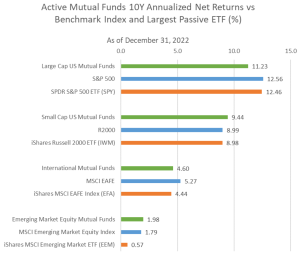

Active Investors in Small-cap and non-US Markets Outperformed Popular Index Funds

Over the past decade many investors abandoned actively traded mutual funds and separately managed accounts in favor of lower cost passive strategies. Morningstar recently estimated that passive funds make up 38% of the global market. The motivation for this shift stems from the belief that

A tough run for the Ivys?

University endowments report their investment performance on a June 30 fiscal year-end. With the market declines last year, the 2022 performance, which tracked July 1, 2021 through June 30, 2022, reflected the double-digit declines of both the equity and bond markets. The largest university endowments

Russia’s Ukraine Invasion will Accelerate Deglobalization and Increase Inflation Risks

Russia invaded Ukraine this week in the largest European military action since World War Two. At this point, Putin’s goal looks to be overthrowing the democratically elected government and installing a puppet regime, like that which ruled the country before the 2014 Revolution. While Russia