University endowments report their investment performance on a June 30 fiscal year-end. With the market declines last year, the 2022 performance, which tracked July 1, 2021 through June 30, 2022, reflected the double-digit declines of both the equity and bond markets. The largest university endowments posted negative returns, but outperformed stocks and bonds thanks to their large allocations to private equity, venture capital and other non-publicly traded investments.

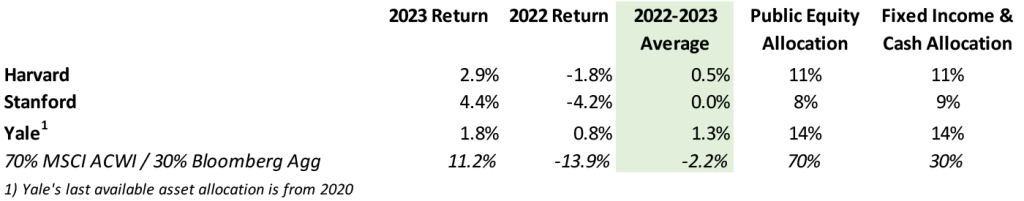

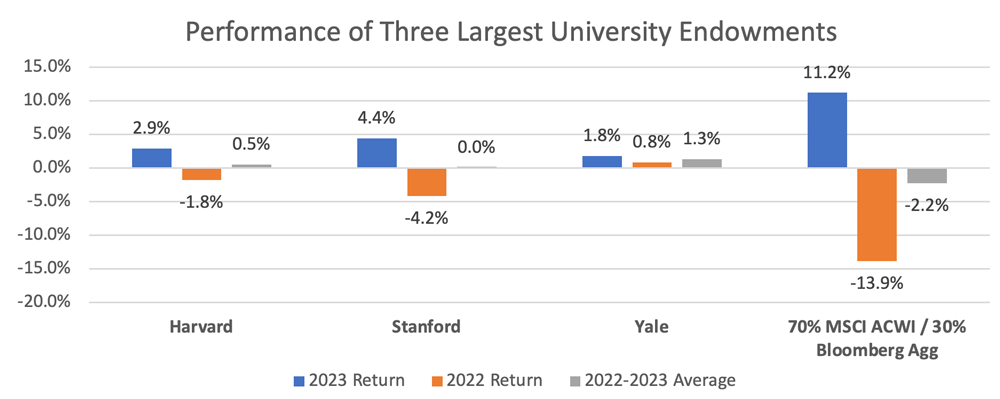

Stocks recovered this year and bond returns were flat to slightly negative, depending on duration. The MSCI All-Country World Index returned 16.4% over the 12 months ending June 30, 2023, while the Bloomberg US Aggregate Bond Index returned -0.9%. A 70/30 mix of these two indexes returned 11.2%. None of the large university endowments returned near this amount. Harvard, Stanford and Yale – the three largest endowments – returned 2.9%, 4.4% and 1.8% respectively. The top-performing endowment on a list compiled by Pension & Investments was the $1.7 billion University of Nebraska Foundation with a 9.8% return – still lagging the simple 70/30 benchmark. The worst result for 2023 came from MIT, which returned -2.9%.

As a recent article from Pitchbook notes, illiquid private investments were responsible for both the ‘outperformance’ and ‘underperformance’ in fiscal 2022 and 2023. Valuations for private equity, venture capital and other illiquid alternatives come from estimates provided by management. This appraisal-based process creates valuations that generally lag public markets and exhibit far less volatility. Accordingly, private investments declined far less than the equity markets in 2022. However, as public markets partially recovered in 2023, private asset valuations were still catching up to last year’s declines in public markets and higher interest rates.

With the typical university endowment allocated around 40% to illiquid alternatives, these lagging valuations provide a significant impact on investment performance. The three largest endowments average nearly 80% in alternative investments, with the majority invested in illiquid alternatives. The performance can be seen below:

For the 2022-2023 period, the large allocation to alternatives added value – the two-year average return beat the -2.2% return of the 70/30 portfolio. The key question for 2024 is whether private market valuations will continue to be revised downward or do they now adequately reflect the current environment of higher interest rates and correspondingly lower asset valuations? N.P. Narvekar, CEO of the Harvard Management Company, notes in their annual report that, “Given the continued slowdown in exits and financing rounds over the last year, it will likely take more time for private valuations to fully reflect current market conditions”.

It may turn out that institutional investors overallocated to private investments. Private equity and venture capital provide participation in key segments of the economy generally unavailable to public equity investors. However, they are generally riskier investments than larger, publicly traded companies. Likely many investments made during the previous decade of ultra-low interest rates will struggle with more expensive borrowing costs. Rather than a panacea for portfolios, illiquid alternatives serve best as a satellite investment – enhancing, rather than driving, portfolio returns.