Over the past decade many investors abandoned actively traded mutual funds and separately managed accounts in favor of lower cost passive strategies. Morningstar recently estimated that passive funds make up 38% of the global market. The motivation for this shift stems from the belief that most active strategies do not outperform over the long term. While this is true for large cap US mutual funds, active investors fared better in small cap and non-US stocks.

Obtaining an unbiased average of mutual fund performance is more difficult than it might appear. Simply averaging the performance of funds in a database such as Morningstar excludes funds that ceased operations prior to the date of analysis. Not surprisingly, the closed funds tend to be the worst performers as these funds lose assets and either close or are merged into other funds, wiping their track record from the fund company’s ledger.

Perhaps the best and most robust measure of actively managed mutual funds is the SPIVA Scorecard, published by S&P Global. The methodology tracks an asset weighted average of all mutual funds within a specific category. Closed and merged funds remain in the dataset which removes the problem of survivorship bias mentioned above.

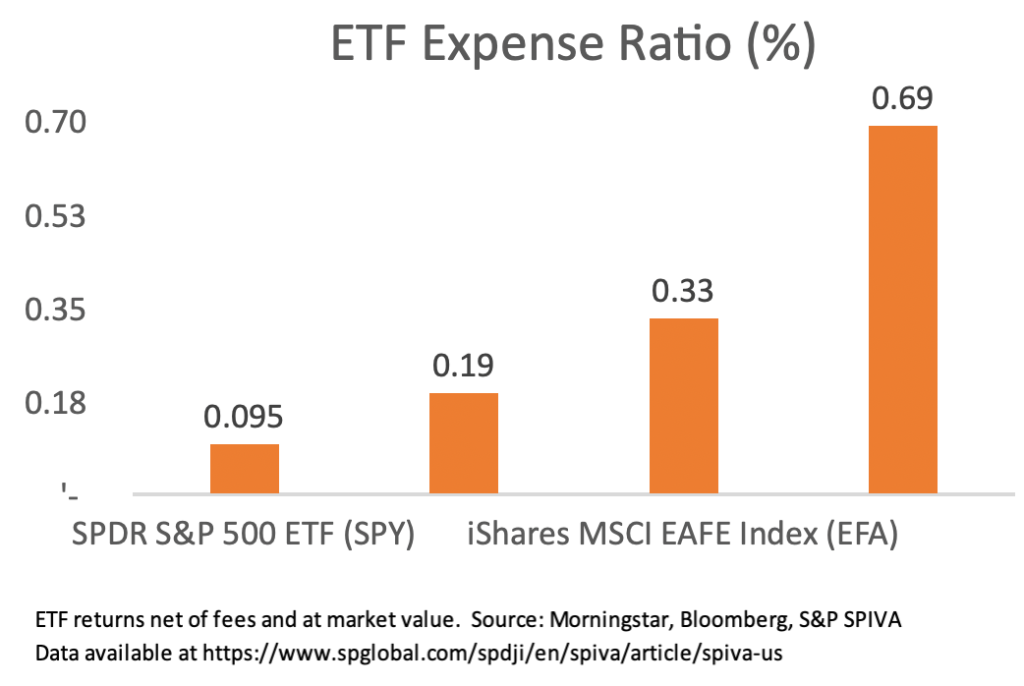

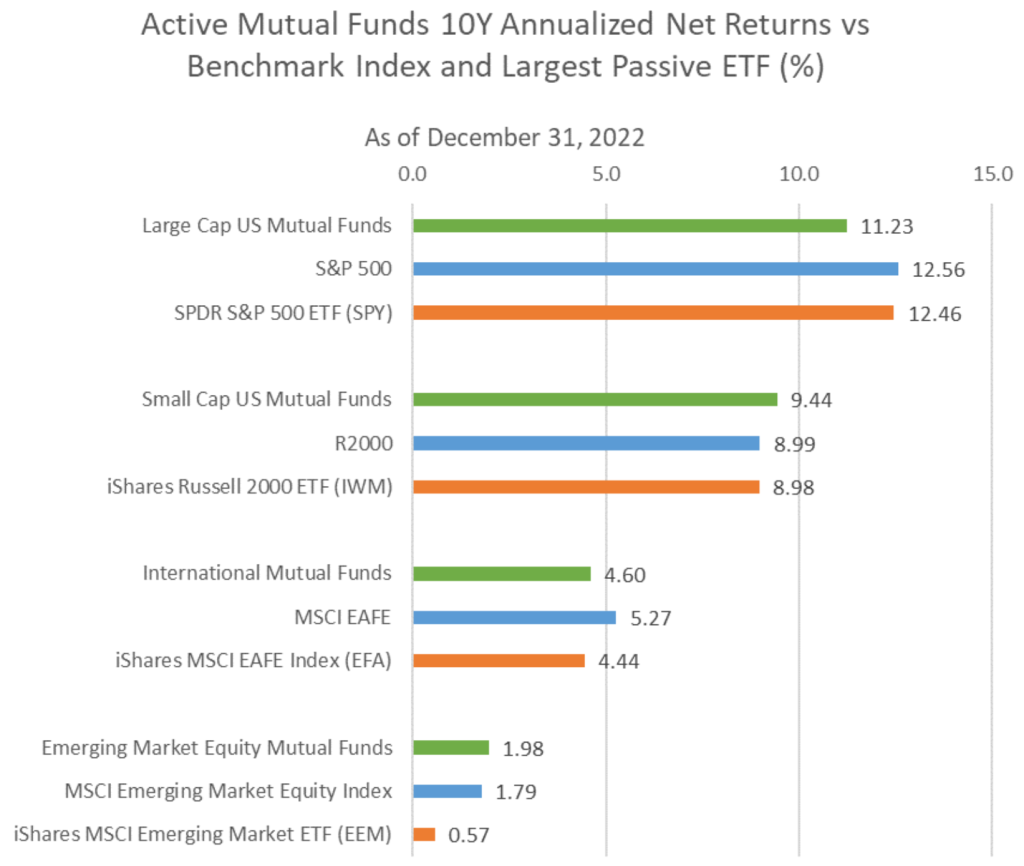

At first glance, the aggregate performance for active mutual funds appears dismal. Large cap US mutual funds lagged the S&P 500 by 133 basis points annually over the 10-year period ending December 31, 2022. However, one cannot directly invest in an index. The popular SPDR S&P 500 ETF (SPY) also underperformed the S&P 500, but only in line with its 0.09% expense ratio.

However, the picture changes with small cap, international and emerging market funds. Small Cap US Mutual Funds, in aggregate, outperformed the Russell 2000 by 0.45% annually over the 2013-2022 period. This outperformance came before factoring in the higher costs of indexing small caps, which totaled 0.19% for the iShares Russell 2000 ETF in this example. Typically, around 1/3 of the Russell 2000 Index consists of money-losing companies, while active managers tend to tilt their portfolios toward higher quality, profitable names.

International Mutual Funds underperformed the MSCI EAFE Index but outperformed the popular iShares MSCI EAFA Index (EFA). However, one cannot directly invest in an index and investing in non-US stocks becomes more expensive due to dividend tax withholding and higher custody and brokerage costs. This is particularly notable with emerging markets, where Emerging Markets Mutual Funds outperformed the MSCI Emerging Market Equity Index by 0.11% but beat the iShares MSCI Emerging Market ETF by 1.41% annualized over the 10-year period. In addition to higher brokerage and custody costs, foreign stock market indexes may not represent the best opportunity set for investors. Large regulated and quasi-state companies comprise a significant portion of the market capitalization, particularly in emerging markets.

While solid arguments exist for passively investing in US large cap stocks, the recent concentration in a handful of technology names could set up a prolonged period of outperformance for active strategies should these names underperform. In small cap, managers can add value simply by avoiding the lower quality companies in the Russell 2000 Index. Outside the US, higher brokerage and custody costs create a larger difference between index and index fund performance, with active managers subject to the same costs. Comparing index fund returns with active managers eliminates the apparent underperformance. Additionally, the prevalence of quasi state-run companies outside the US distorts the opportunity set for investors. Thoughtful active strategies can navigate these issues and add value to portfolios.