Tariff Volatility

Why is the market selling off today when everyone knew that tariffs would beannounced? The Tariff announcement far surpassed expectations The administration’s tariff announcement today

Why is the market selling off today when everyone knew that tariffs would beannounced? The Tariff announcement far surpassed expectations The administration’s tariff announcement today

Humans thrive on stories. Psychological experiments document their effectiveness in communicating information and changing behavior. Neurologists measure the actual changes in brain chemistry that they

This information is presented for educational purposes only and does not constitute an offer or solicitation for the sale or purchase of any specific securities,

After the NVIDIA-driven first half of the year, equity markets broadened during the third quarter. Small cap stocks, emerging and developed non-US markets posted double-digit year-to-date gains. Large cap US growth stocks still retain the lead due to their strong performance during the first half of the year.

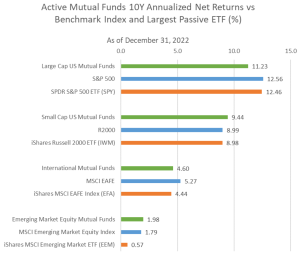

Over the past decade many investors abandoned actively traded mutual funds and separately managed accounts in favor of lower cost passive strategies. Morningstar recently estimated

University endowments report their investment performance on a June 30 fiscal year-end. With the market declines last year, the 2022 performance, which tracked July 1,

Russia invaded Ukraine this week in the largest European military action since World War Two. At this point, Putin’s goal looks to be overthrowing the

With the election results and positive vaccine news, investors now possess a clearer picture of the next few years. A Biden victory, without the predicted ‘Blue Wave’ giving the Democrats dominance in the

Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning. Winston

The last several weeks have seen historic moves in the markets. Large swings, up and down, within a single day have challenged some of the