Only when the tide goes out do you discover who’s been swimming naked.

– Warren Buffett

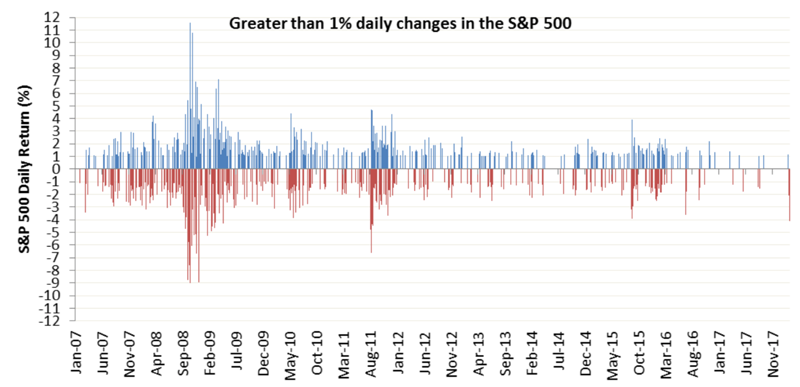

Over the past few quarters, we have expressed concern that this multi-year period of low volatility had created the potential for a structurally driven market decline analogous to those experienced in 1987 or 1998. The catalyst of this potential crash would be the proliferation of investment products whose performance was dependent upon continued low volatility. While forced selling exacerbated yesterday’s selloff, the overall magnitude of the decline remained modest. The -4.1% return for the S&P 500 on Monday only appears dramatic against the benign market environment of the past few years. While the downturn in 2008 erased over a decade of stock price gains, yesterday brought the S&P 500 back to levels no one had seen since Christmas. Few likely remember (we surely did not) that the S&P 500 suffered a similar decline on August 24, 2015. When S&P downgraded the US credit rating on August 8, 2011 the market suffered a 6.7% decline. The graph below illustrates that while infrequent, 4% declines in the US stock market can be expected every few years, even in a benign environment.

So far, the damage has been limited to only those strategies directly betting against spikes in volatility. Two exchange traded products, XIV and SVXY, which sold short the volatility of the S&P 500 look at this point to have been completely wiped out. At their peak last year, these funds had approximately $2.4 billion in assets and had generated seven year annualized returns north of 40%. Short selling volatility is a complicated derivative transaction where the fund essentially sells ‘insurance’ against spikes in volatility, such as we experienced yesterday.

Volatility is not something that can be purchased; it is only implied from the prices of call and put options. Wall Street attempted to make stock market volatility into a fee generating ‘asset class’ and like most novelty investment products, the creators won and investors lost.

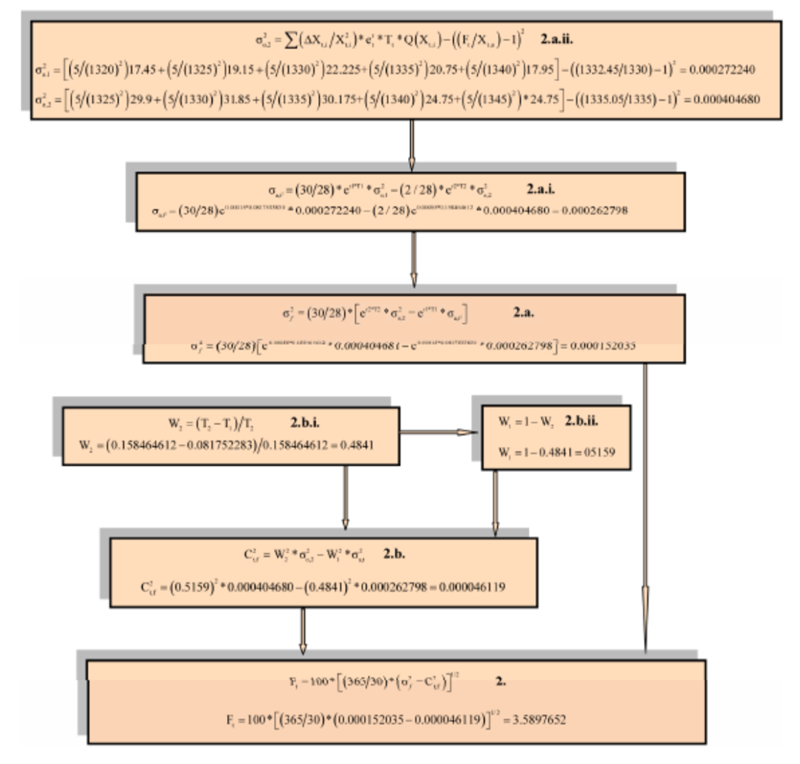

Pricing model for VIX futures, the underlying investment of volatility ETFs1.

What could possibly go wrong here?

Our main near term concern is that we may see further disruptions from hedge funds and other less transparent vehicles that were pursuing this strategy. Fortunately, the markets seem to have been spared a 1987 or 1998 type meltdown and this relatively minor disruption should result in the reemergence of more prudence on the part of both investors and Wall Street. Monday’s meltdown demonstrates the necessity of understanding what you own and avoiding overreliance on past performance. Equity valuations remain elevated and discount lower future returns than have been enjoyed over recent years. Corporate leverage is increasing and interest rates now move in more than one direction. Maintaining a disciplined allocation remains the best course of action for navigating the current environment.

1. Source: G. D’Anne Hancock. Modern Economy, 2012, 3, 284-294 http://dx.doi.org/10.4236/me.2012.33038 Published Online May 2012