While the record flows of investor capital into index funds and ETFs provided good returns during the bull market of the past few years, we remain concerned that much of the outperformance of passive strategies vs active managers was driven by fund flows into these products indiscriminately bidding up the prices of the more thinly held securities in the index. This problem is particularly acute with small cap stocks, where ETF flows can dominate trading volumes.

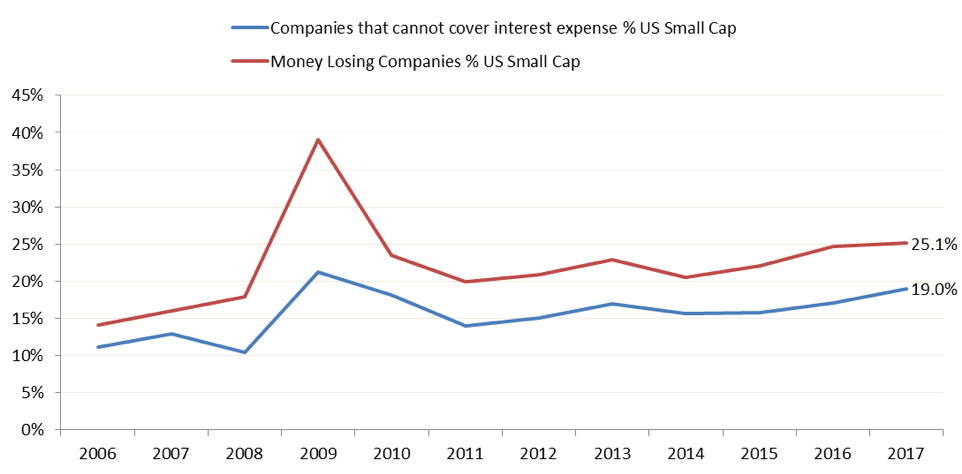

In 2006, approximately 14% of the market capitalization of the Russell 2000 Index consisted of companies that were not making money. This percentage increased to 39% in 2009 due to the recession. Since 2009, the percentage of money-losing companies has not dropped appreciably below 20% and at the end of 2017 it currently stood at 25.1%. Put another way, if you invest in a Russell 2000 ETF or index fund today, one quarter of your money is invested in companies that are not making money, despite a generally benign economic environment. Many of these money-losing companies are biotech companies awaiting FDA approval or young information technology companies and generally have no debt. However, today approximately 19% of the Russell 2000 Small Cap Index consists of companies that are losing money and have debt. The risk here is that if the company goes bankrupt, the stock gets delisted and is worth nothing – no amount of future ETF flows will prop up the price.

Small cap calculated as companies with a market capitalization below the largest listed capitalization of the Russell 2000 at the end of each calendar year. Ranges obtained from http://www.ftserussell.com/research-insights/russell-reconstitution/market-capitalization-ranges. May not exactly match the composition of the Russell 2000 index at that point in time. Source: Bloomberg

Small cap calculated as companies with a market capitalization below the largest listed capitalization of the Russell 2000 at the end of each calendar year. Ranges obtained from http://www.ftserussell.com/research-insights/russell-reconstitution/market-capitalization-ranges. May not exactly match the composition of the Russell 2000 index at that point in time. Source: Bloomberg

Case in point is Frontier Communications (NASD: FTR). Frontier is a rural telecom provider offering broadband, landline and television service. We first became aware of the company through a Financial Times article detailing the very poor creditor protections in its latest bond issue. The company has not made money since 2015. In 2007, the company had a large land line customer base and the stock traded at over $200 /share and paid an annual dividend of $15. In 2016 the company spent over $10 billion of borrowed money to purchase Verizon’s landline business and has lost customers every quarter since then. The company is a primary loser in the trend for consumer ‘cord cutting’- switching to streaming services from cable and satellite TV services. After nearly a decade of cuts, Frontier stopped paying a dividend this year and the stock currently trades around $8.

At this price, the market value of Frontier’s outstanding stock totals around $620 million, which is dwarfed by the company’s $17.8 billion in debt, most of which will have to be refinanced within the next seven years. Bloomberg currently rates the company’s credit just one notch above distressed. Additionally, its 80 million shares of common stock outstanding will be diluted by the addition of over 20 million shares when a mandatory convertible converts at the end of June. The few Wall Street analysts that cover the firm do not project the company becoming profitable over the next four years.

Interestingly, the only institutional owners of Frontier stock appear to be index funds and ETFs. Looking through the list of owners of Frontier, we could not find a single fundamental active manager who owns a share of this company. Its shareholder base consists entirely of index funds, ETFs, and systematic quantitative managers (who buy diverse portfolios based on statistical factors rather than individual company analysis). It seems there are no willing buyers for this company on its merits as a business. With nearly 40% of the outstanding shares sold short, there do however seem to be many willing sellers (albeit that about half of the short interest is likely hedging the mandatory convertible preferred issue).

Admittedly, with a market cap of $620 million, it represents a tiny percentage of the Russell 2000 (0.03% to be exact). However, the issue is that 19% of the index may be in companies like this. The premise of index fund investing has been that stock prices are fair because active managers continuously analyze and trade these based upon their views of their fundamental value. What does it mean for equity markets when a broad swath of stocks becomes entirely owned by funds whose only criteria for purchase is membership in an index?