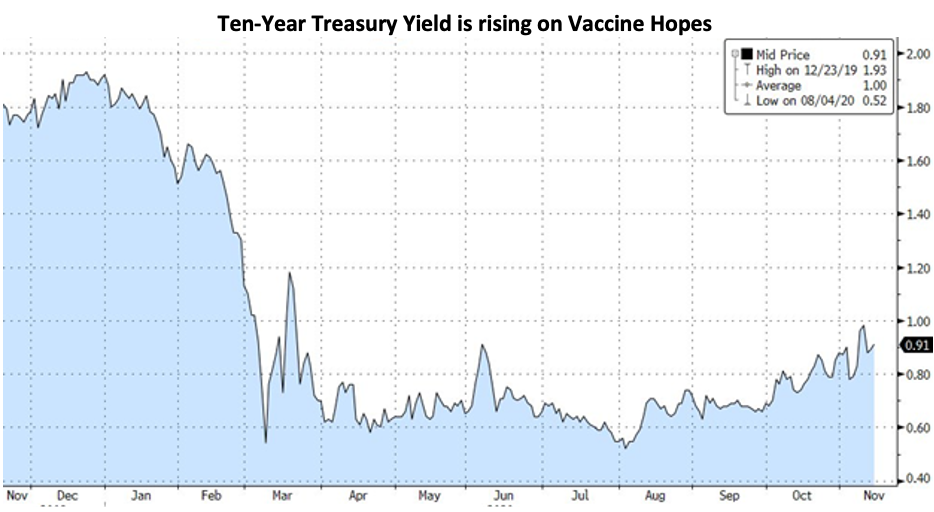

With the election results and positive vaccine news, investors now possess a clearer picture of the next few years. A Biden victory, without the predicted ‘Blue Wave’ giving the Democrats dominance in the Senate, reduces the likelihood of major policy changes. A smaller fiscal stimulus may be the first change. The Democrats had planned on a massive fiscal stimulus, and now a more modest package seems likely. The bond market appeared to be pricing in a large stimulus along with a Biden victory – as the yield on 10 Year Treasury Bonds increased from 0.65% at the end of September to 0.93% at the eve of the election – only to fall to 0.73% the following day as the Democratic wave failed to materialize. Following the election, news of robust Phase 3 results for both the Pfizer and Moderna vaccines’ success spurred a more dramatic spike, sending the yield on the 10 Year Treasury back to nearly one percent.

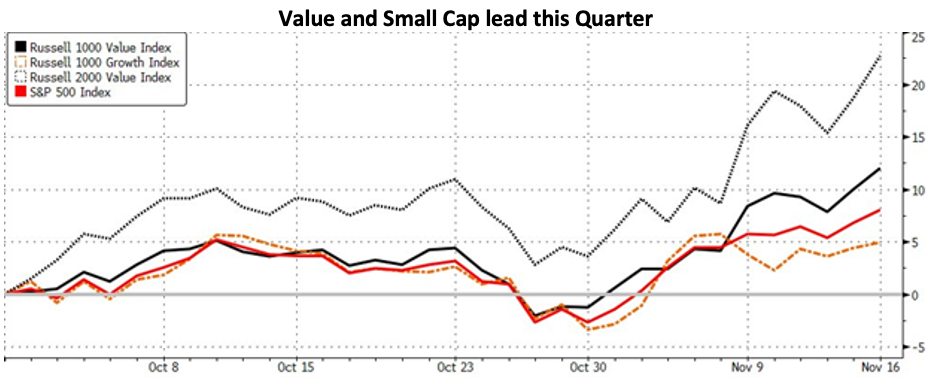

The vaccine successes likely represent the beginning of the end of the COVID-19 pandemic; although, widespread immunizations will not occur before the second quarter. Given the surge in new cases, the next few months appear grim. While the pandemic worsens in the US and Europe, the market appears to be looking past this. Value stocks dominated this quarter. Through midday on November 17, the Russell 1000 Value index returned 12.0% QTD, compared to 4.9% for the Russell 1000 Growth Index. Small cap value stocks were the top performers, with the Russell 2000 Value Index returning 22.7% since September 30. Given that value indexes possess large weights in the industries hardest hit by the pandemic, it makes sense that value will outperform on hopes of its end. However, many of these industries, such as energy, brick and mortar retail, and hospitality, will remain challenged as economies adjust to new work and travel habits. COVID-19 accelerated the secular trend of digitalization of the world economy, and the large gains in many tech stocks this year can be seen as reflecting this. Accordingly, one should not expect this level of outperformance to continue.

It remains to be seen whether the Democrats will obtain a sufficient majority in the Senate to implement Biden’s tax plan. His proposal would tax capital gains at ordinary rates on the amount of income over $1 million and eliminate the step up at death, instead taxing all estates on any unrealized appreciation at applicable income tax rates. While this plan would dramatically increase the tax burden on large estates, it does not make sense to realize gains today. After running an analysis on the impact of the Biden plan, we found that for investors with a time horizon of 15 years or longer, there would be little benefit to realizing gains now and forfeiting the value of compounding to reduce the impact of higher rates at death.

After the sharp declines in March, the gains in the S&P 500 this year surprised many. However, the performance of the market reflects the large gains of a narrow group of tech companies, not the performance of the average stock. This quarter, the market began anticipating an end to the pandemic and broad recovery next year. Accordingly, stocks outside of technology and healthcare have outperformed. While a mid-2021 end to the pandemic appears as the most likely scenario, risks remain, and we expect equity markets to remain volatile. Investors should maintain a disciplined approach, rebalancing where warranted. Elevated equity valuations and meagre bond yields will create a difficult longer term environment for investors. Valuation and quality matter, and will likely be the keys to success in coming years.