Stock market declines tend to trigger discussions of hedging by clients and in the financial press. Often the media presents hedging as a viable way for investors to protect their portfolios, which very rarely is the case. Hedging a portfolio simply means reducing equity exposure. Selling stocks and raising cash is in nearly every circumstance the simplest and most effective way to accomplish this. Hedging techniques employing futures or options encompass costs and risks that usually make them unattractive alternatives.

As most investors hold equity portfolios that differ from the S&P 500, a hedge based on S&P 500 performance will not provide perfect protection. If your stocks underperform the S&P 500, this will effectively increase the cost of the hedge. The term for this in investment jargon is basis risk. In theory, one could try to individually hedge each stock position in a portfolio, but this would prove too expensive and operationally difficult.

Hedging with futures does not provide insurance-like characteristics; rather it provides an identical payout as selling stocks and holding cash. If I hold the S&P 500 Index then fully hedge it by selling an equivalent amount of S&P 500 futures, the resulting portfolio will give me a return equivalent to holding cash, which makes sense, as the portfolio has no risk. The same result can be more easily obtained by simply selling stocks.

Put options, which provide a floor on potential losses while preserving some upside, are the most typically discussed hedging option. These instruments effectively act like an insurance policy. You pay a premium to the writer of the option for protection over a defined period. In exchange, you keep the upside potential and limit portfolio losses. Currently, to protect against a decline from the current value of the S&P 500 over a period of slightly more than one year would cost about 7% of the amount protected. This cost of protection exceeds the 5-6% annual returns we expect from the S&P 500. If the market is lower when the option expires a year later and you still want to protect the current value, you face the choice of either accepting less protection or paying a higher premium. Not surprisingly, the sellers of puts demand compensation for assuming your market risk. This extra return demanded by sellers of puts is called the volatility risk premium in the finance literature. This volatility risk premium makes hedging with puts uneconomic for most investors.

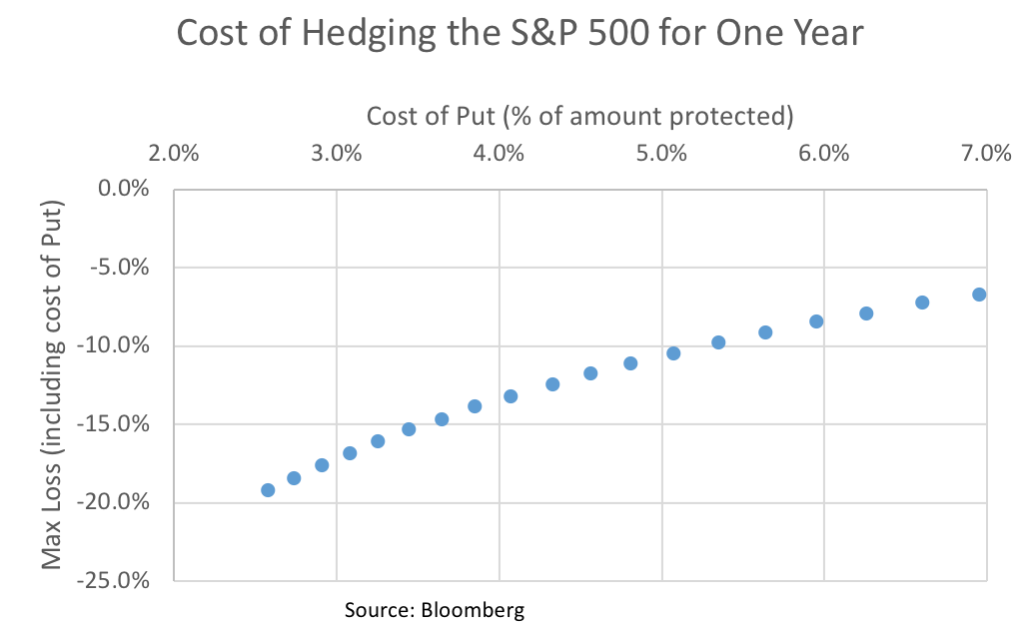

The graph below illustrates the cost tradeoffs to protect an S&P 500 portfolio from Nov 26, 2018 through December 20, 2019:

The maximum protection requires a 7% premium cost. Lower premiums and higher ‘deductibles’ are available at the cost of less protection. Once the contract expires next year, an equivalent level of protection may not be affordable.

A recent study by Roni Israelov at AQR demonstrated the failure of option hedging strategies by noting that a portfolio consisting of the S&P 500 with a rolling 5% out-of-the-money put protection (theoretically protecting against a 5% drawdown less the cost of the put option) had about the same return as a portfolio of 37% S&P 500 and 63% cash but with higher volatility[1]. The scope of the study ran from July 1986 to May 2016, so it included the 1987 crash and all the subsequent bear markets. The poor performance stemmed from cost of the puts and timing of stock market downturns compared to option expiration dates. The latter point warrants some explanation. Puts do a great job (at a cost) of protecting a portfolio (ignoring basis risk) during the life of the option contract. Real world investors want protection over different time periods and this creates difficulties. If I purchase a one-year put option to protect my portfolio and a bear market begins shortly before the expiration of the option contract, I will have to ‘renew my insurance’ at a higher cost or accept rolling over the put contract at a lower strike price. The paper’s conclusions imply that investors concerned about market volatility should simply lower their allocation to stocks rather than try to hedge with puts.

Owning quality assets and an adequate reserve of cash and bonds remains best way to protect a portfolio. Past bear markets have tended to last 5-6 years, measured from the peak through the trough and back to the prior peak level. Therefore, having 5-6 years of planned liquidity needs not exposed to stock market risk constitutes a real hedge for an investor’s financial goals.